07 June 2025

●

1 min read

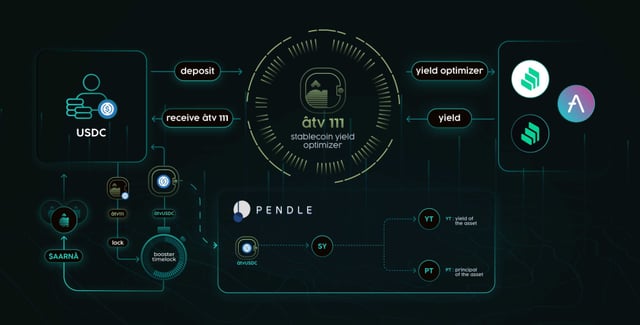

Singapore, 5 June 2025 – aarnâ protocol has activated âtv111, a structured yield vault for stablecoins, along with âtvUSDC, a composable vault token representing staked positions in âtv111. The pre-launch was unveiled during un#6, aarnâ’s invite-only DeFi forum in Singapore, bringing together allocators, funds, and builders focused on the next evolution of onchain asset management.

DeFi yield: where TradFi curiosity meets onchain conviction

The un#6 event opened with a high-signal panel featuring perspectives from both ends of the capital stack - Pendle’s stablecoin & RWA specialist and Citi’s former head of tokenisation - moderated by Sri Misra, founder of aarnâ protocol and a former consumer tech entrepreneur turned DeFi builder. The discussion explored how onchain yield is evolving from degen-fueled APYs to structured products that institutions can actually model and increasingly allocate into.

As stablecoin yield strategies gain traction across both TradFi and crypto-native capital, one challenge remains clear: navigating the yield stack. Switching protocols, tracking rewards, managing risk exposures -it’s fragmented, inefficient, and hard to scale.

aarnâ protocol is building to solve that with âtv111 and âtvUSDC, a new class of tokenized vaults designed to make yield programmable, composable, and efficient across ecosystems.

âtv111 + âtvUSDC: pre-launch

âtv111 is an onchain yield aggregator built to route USDC into top-performing stablecoin strategies across DeFi. It’s designed to simplify access while maximizing underlying returns through dynamic allocation and risk-aware optimization.

With a single deposit, users get exposure to structured, low-volatility yield without needing to manage individual protocols. Deposited assets can be staked to mint âtvUSDC - a composable vault token that reflects participation in the âtv111 yield strategy and accrues protocol rewards, $AARNA incentives, and additional ecosystem-level boosts. The vaults are going live on Ethereum and Sonic.

Roadmap: scaling, stacking, and composability

The rollout of âtv111 follows a phased approach, starting with the pre-deposit window from June 8 to July 15. This gated phase offers early users access to boosted $AARNA rewards through ASRT tokens, which gradually taper as the vault scales -rewarding those who move first.

In the following weeks, aarnâ will expand liquidity through strategic LP partnerships and deploy across multiple chains, including Base, Arbitrum, and the Monad testnet. The Pendle integration is next in line, enabling users to tokenize future âtvUSDC yield, trade it, and stack Pendle incentives -unlocking a new layer of fixed-income strategies in DeFi.

Next, PT-âtvUSDC will be enabled as collateral on lending protocols like Euler and Morpho, while aarnâ’s own loan module will allow native leverage loops. These are designed to increase capital efficiency while keeping yield composable and transparent.

aarnâ protocol is targeting its TGE in Q4 2025, with strong interest from tier 1 exchanges and market makers. The release of the protocol’s $AARNA token dovetails directly with the rollout of âtv vaults and aligns rewards for early depositors and contributors participating in the pre-deposit phase.

Pre-deposit campaign: early access, real rewards

The âtv111 pre-deposit phase starts June 8 and runs through July 15. Whitelisted users will gain access to ASRT multipliers, offering boosted $AARNA rewards at 2024 seed round valuation -on top of vault yield. Early participants can earn up to 4x additional yield, with rewards tapering as vault TVL grows.

Access is code-gated. Eligible users will need a valid code to unlock deposits during this phase. Codes will be distributed via aarnâ’s contributors, selected ecosystem partners, KOL drops and aarnâ socials.

Users can participate through either the web app or mobile dApp -available on iOS and Android. Once verified, whitelisted wallets can deposit USDC into âtv111 and begin earning stacked rewards from day one.

This pre-launch phase is designed to align early capital with vault mechanics and establish the first layer of long-term users participating in structured, onchain yield.

Development structure

The core protocol architecture and smart contract development for âtv111 and âtvUSDC is led by aarna lab, a dedicated engineering team based in India. The team comprises experienced smart contract developers and full-stack engineers with deep domain expertise across DeFi protocols, AI infrastructure, and tokenized systems.

Aarna AI Pte Ltd, based in Singapore, oversees ecosystem strategy and coordinates global contributors to the aarna protocol, which is a decentralized and permissionless infrastructure layer for onchain asset management.

Join aarnâ on This Journey

Stay tuned for more updates, and here’s to continued success, growth, and a journey forward that’s both prosperous and meaningful.

Follow us on socials and join the community to stay connected

about aarnâ

aarnâ is an advanced DeFi asset management platform, designed at the intersection of AI and DeFi, to help users manage their digital assets lifecycle.