19 August 2024

●

1 min read

âtv Timelock & Staking

âtv timelock & staking program is a protocol TVL and liquidity building program. it’s designed to reward early deployers of capital in quant âtv vaults from 800 series (such as âtv 802 and âtv 808), and in the process secure sustainable TVL build up, and create a positive reinforcement cycle for the protocol and token engineering.

This program is a secure and flexible staking plan designed for âtv vault users who deploy capital for accessing âtv vault strategies. This program rewards users with on top APY and pre-sale access to $AARNA. Users can lock âtv tokens for a chosen duration to earn these incentives, thus aligning longer term protocol liquidity (ie TVL growth). Early participants receive higher rewards in the form of higher APY (up to 25%), the rewards are proportional to the lock-up period and the quantum of âtv tokens locked by the users.

what is ASRT >

Rewards are distributed in the form of a shadow token, âtv Staking Reward Tokens ( ASRT ), which is non-transferable and does not hold any real value by itself but can be exchanged for $AARNA, once the protocol token is released. Thus, the ASRT holders have pre-sale access to the $AARNA tokens and will receive them at pre-sale valuation. For calculation purposes, ASRT tokens are assigned a value of $1 USD per token, and their emission would be linked to the APY earned by the users who have staked their âtv tokens.

how does âtv TimeLock work >

The token cycle in the âtv Timelock & Staking program starts when a user deposits assets into the âtv vaults and receives the âtv tokens in return. Once the depicted stables are cumulatively swapped by the vault into underlying portfolio tokens of the vault, which could take anything from 2-20 hours, these âtv tokens can then be staked in the âtv Timelock contract to earn additional APY rewards. The non-debit locking mechanism ensures that staked âtv tokens remain securely locked in users' wallets, preventing physical withdrawal during the staking period. Users can initiate the unstaking process to regain control of their âtv tokens and access their initial deposits. Rewards are calculated based on the longest lock period before unstaking.

As a simple illustration, if a user invest in any âtv vault during the initial 3 month beta phase, and lock the âtv tokens for 6 months, then at the end of 6 month lock period the user will be able to redeem an APY of 15%, whereas if user unstakes only after 5 months then the APY will be calculated at the longest lock period before 5 months ie. 3 months, so user’s APY will be 12.5%.

âtv staking is a limited program

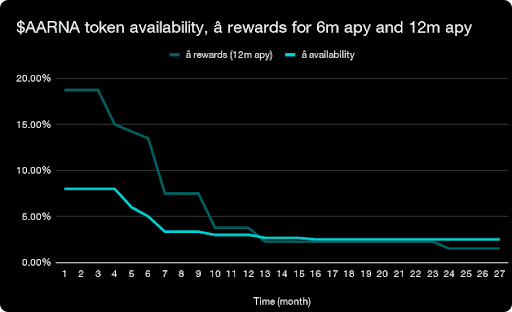

The maximum cap is set at 2% i.e., 2 million $AARNA for the Launch period to incentivize early participation, and a subsequent 10% i.e., 10 million $AARNA is set for next 24 month period to encourage long-term commitment. The seed round valuation of $AARNA is $0.40 USD. Assuming this to be the minimum conversion price, ASRT supply is limited to 2mn tokens as well, as conversion ratio of ASRT : $AARNA is expected to decrease over time as the protocol progresses.

security >

All contracts of the âtv tokenization platform are thoroughly tested and have undergone intensive security audit by Certik. The audit azores and reports can be accessed on Skynet >.

about aarnâ

aarnâ is an advanced DeFi asset management platform, designed at the intersection of AI and DeFi, to help users manage their digital assets lifecycle.