13 June 2025

●

1 min read

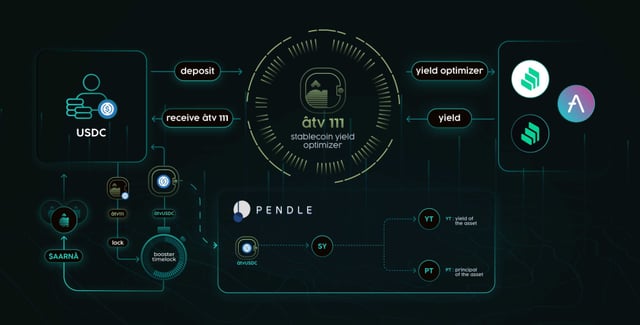

aarnâ protocol has activated âtv111, a structured yield vault for stablecoins, along with âtvUSDC, a composable vault token representing staked positions in âtv111.

The âtv111 pre-deposit phase starts June 8 and runs through July 15. Whitelisted users will gain access to ASRT multipliers, offering boosted $AARNA rewards at 2024 seed round valuation -on top of vault yield. Early participants can earn up to 4x additional yield, with rewards tapering as vault TVL grows.

Access is code-gated. Eligible users will need a valid code to unlock deposits during this phase. Codes will be distributed via aarnâ’s contributors, selected ecosystem partners, KOL drops and aarnâ socials.

Users can participate through either the web app or mobile dApp -available on iOS and Android. Once verified, whitelisted wallets can deposit USDC into âtv111 and begin earning stacked rewards from day one.

This pre-launch phase is designed to align early capital with vault mechanics and establish the first layer of long-term users participating in structured, onchain yield.Reward Structure

During the pre-deposit window, users who hold âtvUSDC will automatically earn ASRT — non-transferable staking reward tokens that can be redeemed for $AARNA during the token generation event. The earlier you participate, the higher your multiplier.

Weekly snapshots track âtvUSDC holdings and distribute rewards via Merkl. There are no minimum durations or lock-ins — users can deposit or withdraw at any time while still earning proportional rewards.

Total ASRT rewards are capped at 10 million, equivalent to 10% of the $AARNA supply, making this a limited-time opportunity to compound yield and earn early protocol ownership.

What is âtv111?

With a single deposit, users get exposure to structured, low-volatility yield without needing to manage individual protocols. Deposited assets can be staked to mint âtvUSDC - a composable vault token that reflects participation in the âtv111 yield strategy and accrues protocol rewards, $AARNA incentives, and additional ecosystem-level boosts. The vaults are going live on Ethereum now and in 2 weeks on Sonic.

Roadmap: scaling, stacking, and composability

With âtv111 now live on Ethereum, aarnâ is entering a phased expansion focused on deepening liquidity and enhancing cross-protocol interoperability. The vault will go live on Sonic in two weeks, is live on the Monad testnet and will be followed by deployments on Base, Arbitrum and Solana. These deployments are aimed at routing stablecoin liquidity across ecosystems while maintaining the vault’s core principles of risk-aware optimization and transparency.

Beyond multi-chain access, composability will play a key role in shaping utility. Upcoming integrations with Pendle will allow users to tokenize future âtvUSDC yield, trade it, and access fixed-income strategies layered with additional incentives. In parallel, PT-âtvUSDC will be enabled as collateral on lending protocols such as Euler and Morpho, unlocking lending opportunities and leverage loops for users seeking higher capital efficiency. aarnâ’s own native loan module is also in the works to further streamline this experience.

The protocol is targeting its token generation event (TGE) in Q4 2025. This launch is timed to coincide with vault adoption and ecosystem expansion, aligning the introduction of the $AARNA token with utility-driven milestones — and cementing long-term alignment between contributors, depositors, and the broader community.

Join aarnâ on This Journey

Stay tuned for more updates, and here’s to continued success, growth, and a journey forward that’s both prosperous and meaningful.

Follow us on socials and join the community to stay connected

about aarnâ

aarnâ is an advanced DeFi asset management platform, designed at the intersection of AI and DeFi, to help users manage their digital assets lifecycle.