25 November 2024

●

1 min read

Institutional TVL Plan

aarnâ is an advanced DeFi asset management platform that converges AI and tokenization technology to help high value users manage their digital assets lifecycle. aarnâ’s âtv structured products are especially suited for sophisticated institutional investors.

aarnâ's Institutional TVL Plan is designed to offer a compelling opportunity to optimize institution's crypto asset allocation through tokenized structured products, while benefiting from enhanced rewards for higher commitments.

aarnâ tokenized vaults

âtv 802 is a quant strategy for crypto assets, a digital assets tokenized product, or vault, for investors seeking consistent alpha in the crypto market, whilst limiting downside risk. âtv 802 utilizes aarnâ’s alpha 30/7 AI deep learning model which predicts high potential tokens, dynamically managing a diversified portfolio of top assets. the âtv 802 vault then executes transactions directly via smart contracts to rebalance the portfolio regularly

âtv 111 is designed to optimize yield for stable coin holders - focusing on USDC holders. Through dynamic allocation, and incentive-driven staking, the vault is designed for users to achieve maximum passive yields with minimal friction. APYs earned are in USDC from staked protocols, and reflected in the TVL and NAV of âtv111 on-chain. Additional rewards up to 2x APY are released by aarnâ protocol with its native $AARNA token. âtv 111 provides a competitive APY around 9-10% on USDC, comprising both USDC and $AARNA incentives as a multiplier.

higher staking rewards tailored for institutional investors

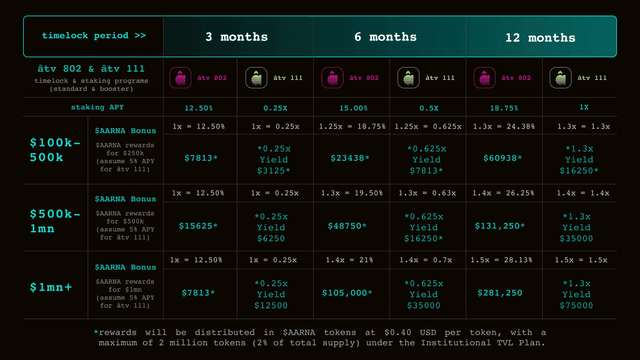

institutions investing through the aarnâ Institutional TVL Plan can take advantage of higher staking rewards with their higher deployment amounts. The âtv TimeLock and Staking and the âtv booster Timelock and Staking programs have been designed to secure liquidity on aarnâ and reward early contributors of capital. By locking in your investment, you gain access to tiered APYs and exclusive bonus rewards distributed in $AARNA tokens

key features and benefits

1. institutional-grade staking rewards

Institutions participating in the aarnâ Institutional TVL Plan gain access to boosted reward APYs which range from an enhanced factor of 1.25x to 1.5x depending upon period locked. This program is valid for a limited time only, for early institutional contributors. Through the âtv TimeLock and Staking and the booster TimeLock and Staking Programs, aarnâ protocol provides tiered incentives that secure ecosystem liquidity while rewarding early institutional contributors.

2. staking tiers and rewards structure

the Institutional TVL Plan offers three main tiers, each tailored to enhance returns.

the higher the allocation and the longer the commitment, the greater the rewards.

3. exclusive access to $AARNA token growth

the âtv timelock programs are also designed with a view to have longer term incentive alignment for institutions, and this is achieved by providing access to the protocol’s native token at seed round valuation. Reward APYs are distributed in $AARNA tokens, currently valued at $0.40 per token. A maximum of 2 million $AARNA tokens (representing 2% of the total supply) has been reserved for this initiative, allowing institutional participants to benefit from the protocol’s long-term growth.

why institutional investors choose aarnâ

- efficient fee structure: zero management fees; only 1% transaction fee and 10% performance fee

- decentralized security: self-custodial architecture eliminates counterparty risks

- autonomous execution: transactions are managed on-chain, reducing inefficiencies and ensuring transparency

- âtv collateralization: Future access to collateralized loans with up to 50% LTV for âtv111 and âtv802 holders

contact us

connect with our team today to discuss how your institution can benefit from the aarnâ Institutional TVL Plan