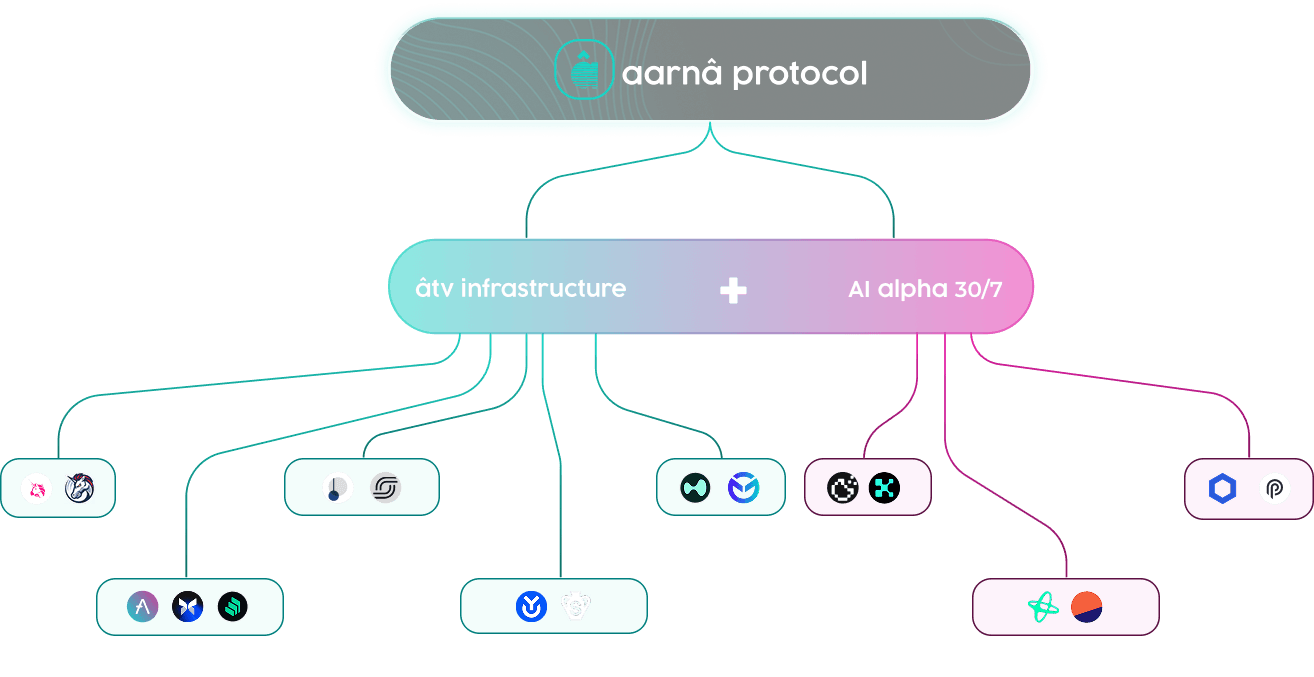

DeFi's full-stack asset manager

for serious capital

risk-managed on-chain vaults for safe yield. early LPs capture boosted APYs and preferential access to $AARNA at seed valuation

avg APY

30%+

composable

tier 1 audits

partners

the deal

estimatedAPY

30%

investmentasset

âtvUSDC

minsize

$50k

deploy in atvUSDC/ETH, aarnâ’s stablecoin yield aggregator vault, to earn 20–30% APY. earn base yield of 4–6% from underlying lending markets like Aave and Compound, with an additional 16–24% in ASRT rewards, convertible into $AARNA at a $40M FDV through fair launch. boost returns further through Pendle vaults, offering up to ~30% APR

genesis tranche

$5M (first slice of a $10M program)

up to 4x on-top ASRT incentives

soft-lock for 3 months

ASRT rewards ( 3x) + LP booster (1x)

designed for early capital deployers who want maximum upside and are willing to commit conviction.

TVL tranche

genesis LPs (0-$5M)

later LPs ($5-8M)

later LPs ($8-10M)

total ASRT rewards with multiplier

4x

3.7x

3.5x

genesis LPs (0-$5M)

ASRT rewards multiplier4x

later LPs ($5-8M)

ASRT rewards multiplier3.7x

later LPs ($8-10M)

ASRT rewards multiplier3.5x

âtvUSDC

on-chain stablecoin yield vault

âtvUSDC is an ERC-4626 token, allocating USDC across established markets like Aave and Compound v2/v3. It wraps strategies like lending & liquidity provision into a single liquid, yield-bearing token tradable on DEXs. It abstracts active management, delivering transparent, non-custodial access to diversified DeFi income streams

ASRT

an alpha yield opportunity

ASRT (aarnâ staking reward token) is designed as the high-upside token for early capital deployers. Launched fairly with no insider-heavy allocations, ASRT ensures that those who bootstrap aarnâ’s TVL capture meaningful upside. Each ASRT converts into $AARNA at a $40M FDV, the 2024 seed-round valuation giving holders preferential access ahead of TGE

audited by leading firms

secure and battle-tested

capital stays safe, verifiable, and

fully under control

atvTokens represent deployed capital, which is fully redeemable on-chain without intermediaries

capital deployed only into deep, liquid markets like Aave & Compound

no lockups, queues, or hidden buffers- withdrawals executed directly on-chain

backers & institutional bridge

aarnâ is backed by leaders who’ve run multi-billion-dollar asset managers in India, family offices with Goldman Sachs heritage in the US, senior executives from Chase and Citi who led digital payments and tokenization, pioneers like the cofounder of Ocean Protocol, and business families with deep middle east networks. together, they form the bridge for TradFi capital to flow into DeFi, directly into aarnâ’s vaults

ASRT > $AARNA

Holding $ASRT unlocks preferential access to $AARNA ahead of its TGE at the 2024 seed valuation of $40M FDV. $AARNA drives the vision of a full-stack on-chain asset management platform, uniting AI-driven portfolios, tokenized yield, and indexed strategies. Where peers focus on isolated slices, $AARNA is building the category set to define the next cycle of DeFi

more on ASRT & $AARNA

building up for a successful TGE

MM & exchange

partnering with an Institutional-grade market-maker, combined with onboarding one tier-1 exchange and multiple tier-2 exchanges, ensuring smooth market entry

GTM & narrative

through the Quintet Program, partnering with five top crypto thought leaders, the Alpha Un# podcast and newsletter featuring prominent voices, and a network of 300 micro-KOLs plus 50 mid-size KOLs, building a strong TGE narrative

meet the team

Sri is the founder & chief Architect of aarnâ. a repeat entrepreneur with expertise in decentralized finance, consumer markets, and product dev, he previously built and exited Milk Mantra, India's first VC-backed food-tech startup ( backed by Fidelity), pioneering ethical sourcing and purpose-driven capitalism

earlier, Sri led international M&A in London with the Tata Group, an Aspen Institute and Yale World Fellow, he is an engineer with an MBA and a PGP in AI & ML from UT Austin, bringing together technology, finance, and consumer insight into the multi-chain era

he is backed by an accomplished team:

data scientist with AIML x wealth management expertise across global banks

systems architect from big tech with cloud-native experience

11 engineers across Solidity, AI, full-stack, and DevOps

4-member growth team

frequently asked questions

you do. LPs always retain self-custody via atv Tokens (ERC-4626), instantly redeemable on-chain

no. withdrawals are instant, no redemption queues, no hidden buffers

native lending yield from Aave/Compound + ASRT rewards convertible into $AARNA at the seed investor price ($0.40)

use the return simulator. It shows base yield and ASRT rewards clearly broken down by deposit size

early LPs earn boosted ASRT rewards later converting to $AARNA, and lock in seed-level pricing

fully composable ERC-4626 token: redeem instantly, trade on Pendle, LP in Dex like Balancer, and soon on other leading DeFi markets

TradFi & DeFi leaders from WhiteOak Capital, Citi, Chase, Ocean Protocol, and SBM Bank